Could one bad Apple spoil the whole barrel?

The extent to which a small number of large companies supported the major stock index returns in 2021 has been well written about in the financial press. For example, a ...

Does your swimming costume still fit?

As the pandemic continues into its third year, many of us had to put our overseas holiday plans on hold again in 2021. Whilst it is sensible to hold off ...

A Healthy Opportunity Set

The movements of popular stock indices dominate the headlines, and all too often the psyche of investors. Given the large price increases in most stock indices for the year, it ...

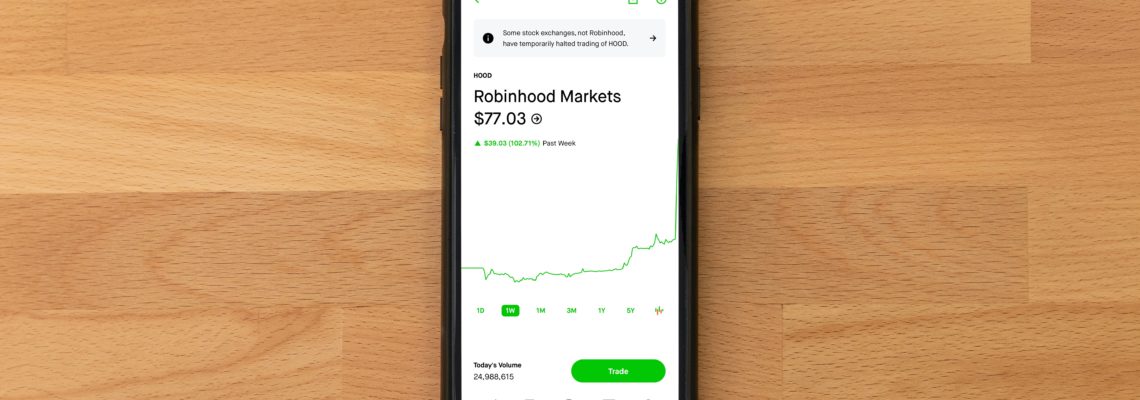

Stealing from the poor to give to the rich

I have written before about my concerns over the optimism that is required to justify the valuations of many popular “growth” stocks. The analysis that follows will further explain why ...

A letter from Matthew Beddall

Three years have now passed since Neil and I launched the Havelock Global Select Fund. In this time the fund has returned 29.9% and is ranked in the top quartile ...

Investing in a low return world

In response to the global pandemic central banks and governments have delivered record amounts of economic stimulus. Much of this has taken the form of increasing money supply via buying ...

Havelock fund awarded Square Mile rating

We are delighted to announce that the LF Havelock Global Select Fund has been awarded a 'Positive Prospect' rating by Square Mile Investment Consulting & Research Limited. In their summary, ...

Matthew Beddall interview

Havelock London's Matthew Beddall talks to Octo Members Club about the LF Havelock Global Select Fund ...